Lending a Hand with Technology

Customers or borrowers value faster loan sanctions. However, this process takes time when done manually. The traditional methods of loan approvals will likely make borrowers switch to those lenders who leverage more efficient digital lending systems. This infographic explains why digital lending systems will take center stage.

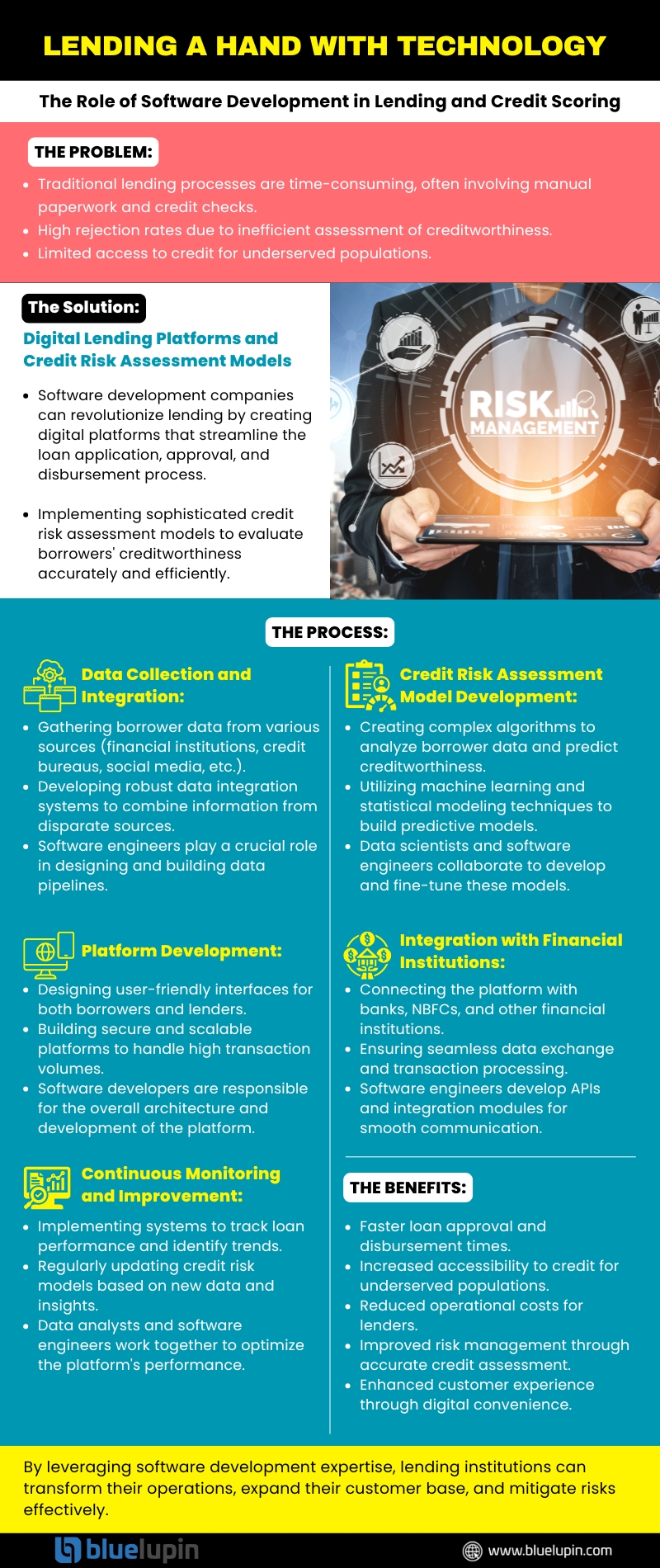

Shortcomings of the traditional lending process

Small or medium-sized businesses and enterprises prefer faster and hassle-free loan application processes. Meanwhile, traditional lending systems are not preferable options anymore. The reasons:

1. Lengthy approval process because of complex paperwork.

2. Various banking and lending institutions take time in credit scoring because of manual dependency.

3. Loan rejection rates are high due to ineffective assessment of creditworthiness.

4. Time-consuming process, fixed age-old repayment rules, high risk of collateral loss, and inflexible eligibility criteria for becoming a borrower.

Key Advantages of Digital Lending Platforms

From automating the submission of required documents to assessing creditworthiness, digital lending platforms offer speed like no other process. ScoreMe, MoneyTap, MobiKwik, and LendingKart are some of the popular names in the digital lending sector.

1. Cross-verifying the applicant’s financial background for assessing credit scores, happens automatically without the intervention of human beings.

2. Digital platforms also help choose the best loan option based on the applicant’s credit history.

3. Applicants don’t need to go anywhere or take a day off.

4. Digitization also has automated the decision-making process and sanctioned loans within a few days if not hours.

5. Error-free and faster loan approvals help in business.

6. Lenders can easily track borrower’s behaviors and prevent fraud.

The shift towards digitization of lending and credit scoring

AI-enabled systems provide tailored loan plans based on borrower’s requirements and financial history.

Borrowing money via mobile apps has become a new norm.

Seamless integration with other necessary custom software and accounting platforms smoothens loan approvals.

The use of AI and ML replaces manual paperwork with automation and also improves risk management procedures.

Due to blockchain lenders witness more transparent loan disbursements and track borrower’s behavior at their fingertips.

How the top software development company in India helps banks and FinTechs digitize lending processes

Traditional banking institutions, Fintech companies, and other lending businesses are gradually shifting towards digitization to provide better services. Building a digital platform solely for borrowing and lending purposes requires professional intervention.

The expert team of a top software development company in India develops custom software for lending and credit scoring. Be it a mobile or web application, they integrate AI, ML, blockchain, and other advanced technologies for automating and streamlining the process of loan disbursement.